Unlocking Real Estate Investment Opportunities: Exploring Various Mortgage Options for Savvy Investo

- Joshua Ashby - Young

- Nov 7, 2023

- 2 min read

Updated: Nov 8, 2023

Investing in real estate can be a lucrative venture, but finding the right financing option is crucial for success. As a savvy investor, understanding the different types of mortgages available is essential. In this blog post, we'll explore various mortgage options for real estate investors, while incorporating common search terms to help you navigate this complex landscape.

1. Traditional Fixed-Rate Mortgage:

A traditional fixed-rate mortgage is a popular choice among real estate investors. This type of mortgage offers stability and predictability, with a consistent interest rate over the life of the loan. Investors often search for terms like "fixed-rate mortgage benefits" and "how to qualify for a fixed-rate mortgage."

2. Adjustable-Rate Mortgage (ARM):

For investors who are comfortable with some level of risk, an adjustable-rate mortgage can be an attractive option. An ARM typically offers a lower initial interest rate, making it appealing to those searching for "low initial mortgage rates" or "pros and cons of adjustable-rate mortgages."

3. Interest-Only Mortgage:

Interest-only mortgages allow investors to pay only the interest for a specified period, which can free up cash for other investments. This option is sought after by those looking for "interest-only mortgage details" or "is an interest-only mortgage right for me?"

4. FHA Loans:

The Federal Housing Administration (FHA) offers loans with low down payment requirements, making them appealing to first-time investors. "FHA loan eligibility" and "FHA vs. conventional loans" are common search queries for aspiring investors.

5. VA Loans:

If you're a veteran or active-duty military member, VA loans offer favorable terms, including zero down payment. Many veterans search for "VA loan benefits" and "how to apply for a VA loan" when considering real estate investments.

6. Hard Money Loans:

Investors interested in quick financing may turn to hard money loans, often used for fix-and-flip projects. They search for "hard money loan terms" and "finding reputable hard money lenders."

7. Jumbo Loans:

For high-end real estate investments, jumbo loans provide funding beyond conventional loan limits. Investors often look for information on "jumbo loan requirements" and "jumbo loan interest rates."

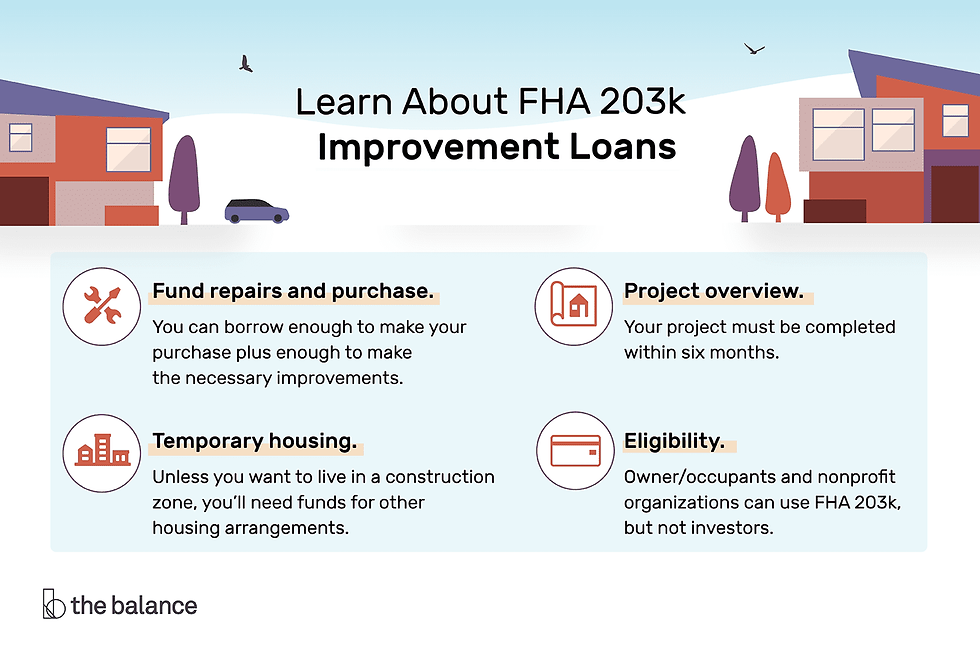

8. 203(k) Rehabilitation Loan:

For investors interested in renovating properties, a 203(k) rehabilitation loan can be ideal. "How does a 203(k) loan work?" and "advantages of 203(k) loans" are common search phrases.

9. Cash-Out Refinancing:

Real estate investors can tap into their property's equity with cash-out refinancing. "Cash-out refinance process" and "when to consider cash-out refinancing" are frequently searched topics.

10. Private Money Lending:

Private money lenders offer flexibility and speed in obtaining real estate financing. Investors explore "private money lending pros and cons" and "finding private money lenders near me"

Choosing the right mortgage for your real estate investment is a crucial decision that can impact your success and profitability. By understanding the various mortgage options available and considering the common search terms discussed in this post, you'll be better equipped to make informed investment decisions. Whether you opt for a fixed-rate mortgage, an ARM, or explore other options, thorough research is the key to unlocking your real estate investment potential

Don't navigate the real estate market alone! Call Joshua Ashby-Young at 727-317-8726 or email at josh@ashbyyoungrealestate.com for personalized guidance in St. Petersburg

Comments